Featured Resource

Endow Iowa Tax Credit

Gifts to endowed funds at the Community Foundation could be eligible for this generous tax benefit.

Download NowFor Professional Advisors

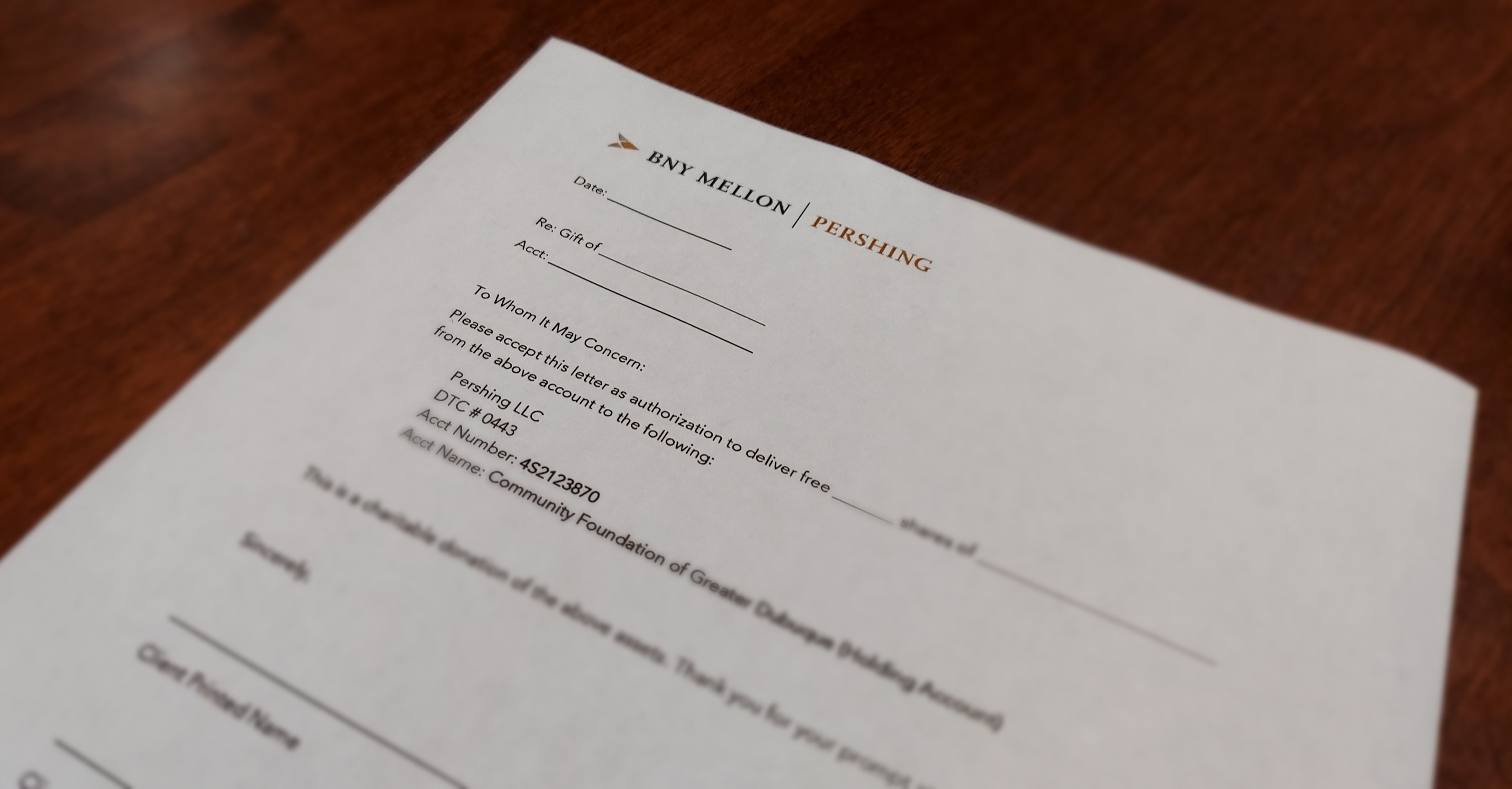

It is no small task to help your clients maximize the benefits to them and their community.

That’s why we work with you to connect clients with charitable options that address community needs and ensure their generosity makes an impact for generations to come.

What is a Community Foundation?

We are a community resource you can turn to when your clients have questions about charitable giving.

Explore and share our resources that help answer your clients' questions about charitable giving.

Endow Iowa Tax Credit

Gifts to endowed funds at the Community Foundation could be eligible for this generous tax benefit.

Download Now

Learn about the many ways we can support you and your clients.

Learn MoreHelp your clients achieve their charitable goals

Learn More

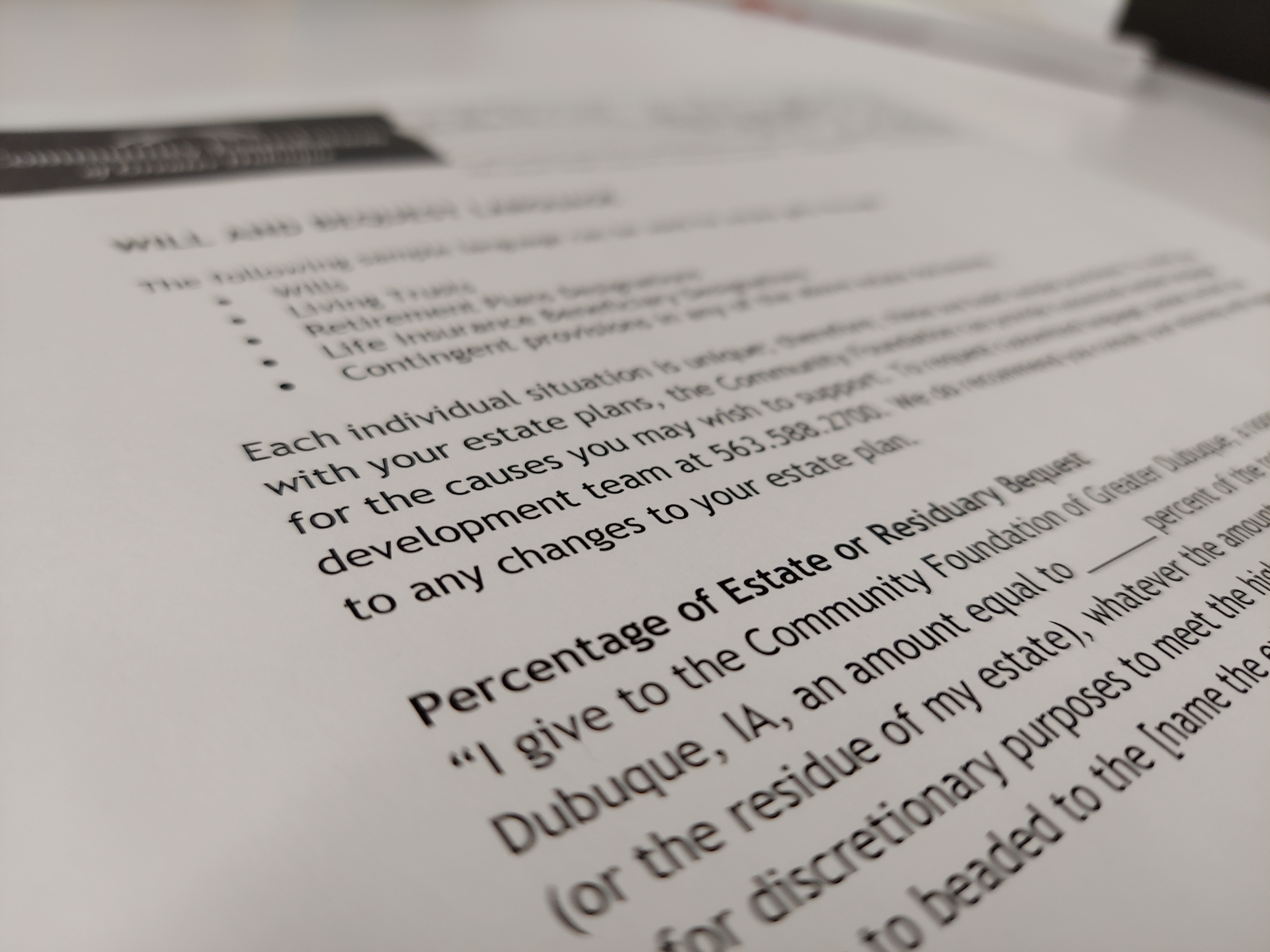

Preserve a portion of our community's projected wealth transfer in an endowment to build a strong region for the future.

Learn More

Roger Hill, Trust Officer, Clinton County

“The Community Foundation offers wonderful ways to provide additional income to the donor while they are living and make a great gift when they are gone.”

Client & Community Benefits

With our deep understanding of community needs, knowledge of charitable giving, and prudent fiscal policies, we give people the peace of mind that their generosity is doing the most good for the community. Plus, your clients' gifts to any of our endowed funds could come with substantial personal tax benefits.

Bryan Knudson, CFP, Ameriprise Financial

“When you can combine the ease of gifting through the Foundation with tax benefits, particularly that the state of Iowa offers with its endowment program, that’s a good combination."

"A large estate isn’t necessary to make a big impact. Clients of modest means have many options for giving, such as a charitable rollover contribution from their individual retirement account."

You have your clients’ best interests at heart. So do we.